Blackstone Property Partners

Europe Holdings

Overview

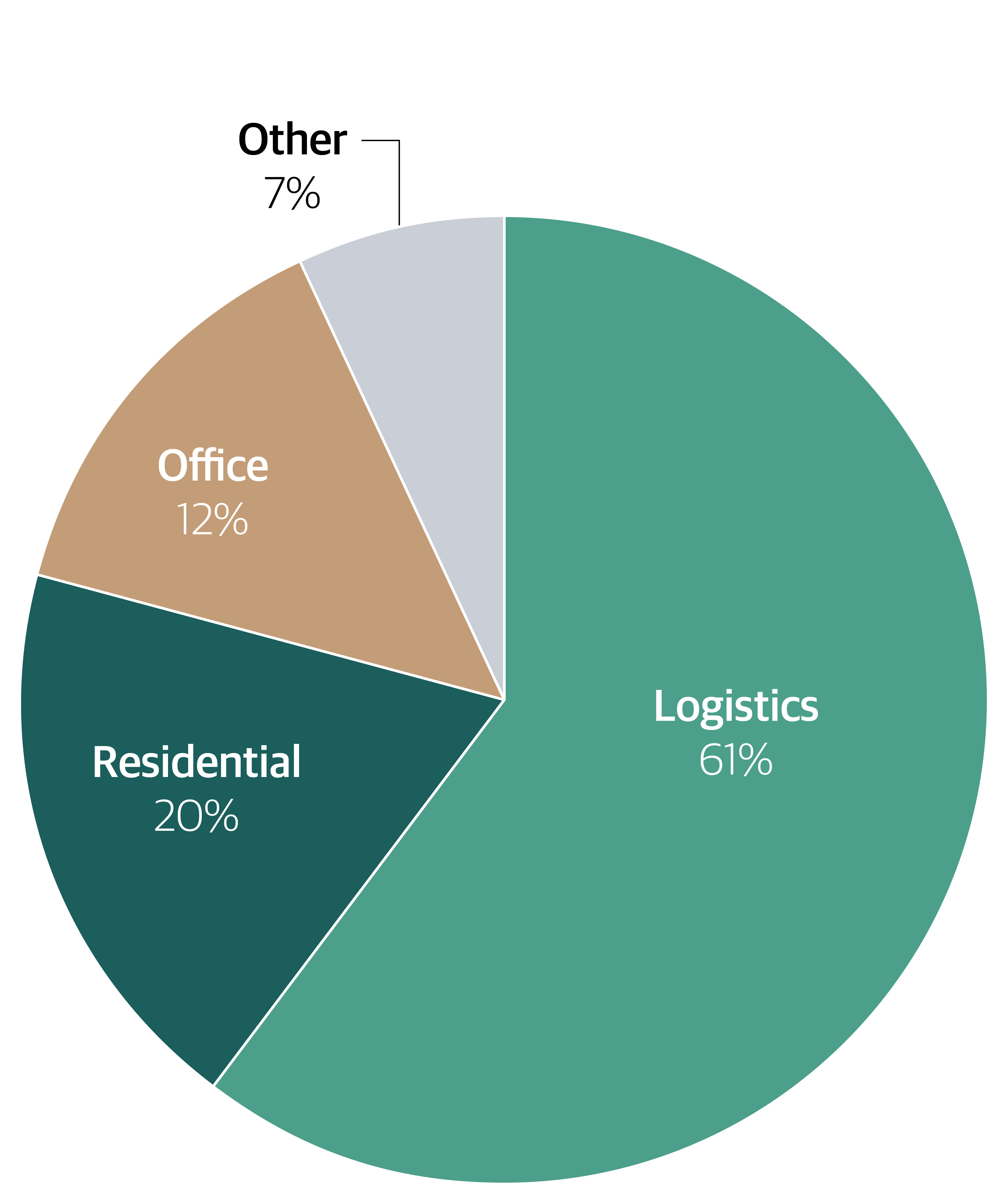

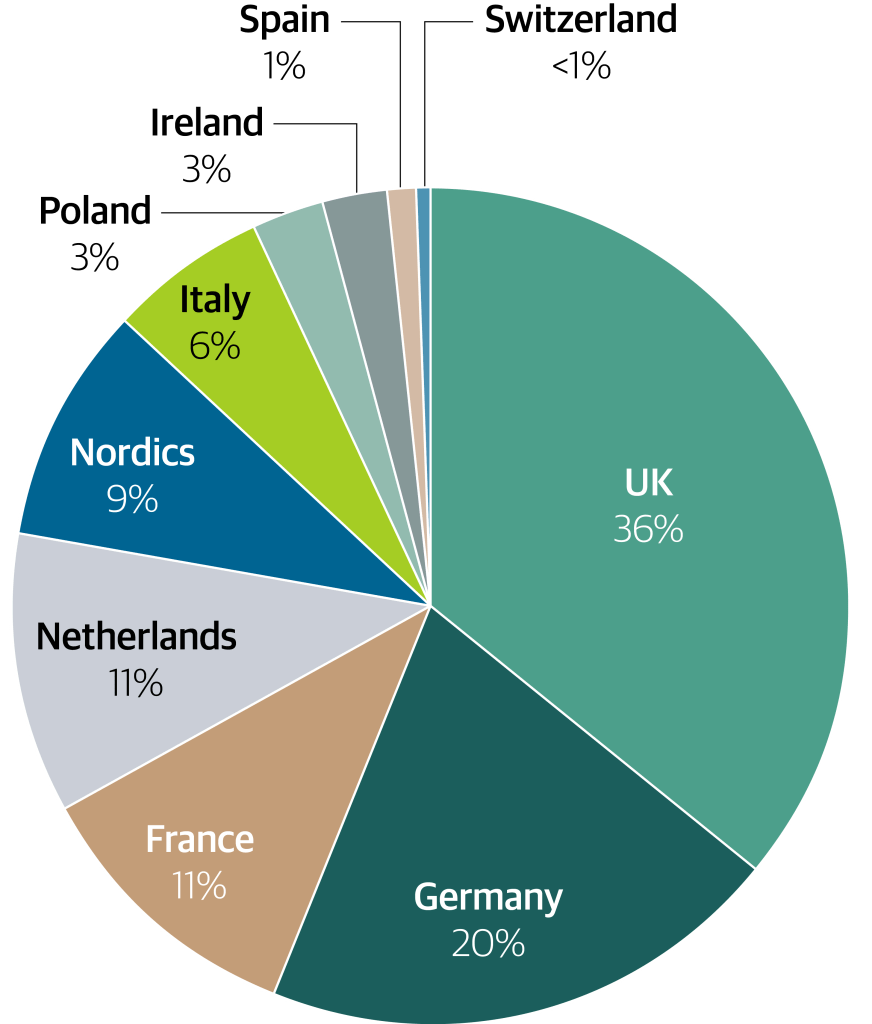

Blackstone Property Partners Europe Holdings (“BPPEH”) invests in high-quality, substantially stabilised real estate assets across Europe. Investments are concentrated primarily in the logistics, residential and office sectors, with a focus on major European markets and key gateway cities. BPPEH is 100% owned by Blackstone Property Partners Europe, which is part of Blackstone’s Core+ investment strategy. Blackstone is the largest owner of commercial real estate globally.

Solid Capital Structure

42%

net LTV

BBB

S&P credit rating

Portfolio Summary

Note: All metrics as of 30 June 2025. Vacant assets under redevelopment and a Milan office asset not actively being leased in advance of repositioning are excluded from operational metrics but included in GAV and number of properties. Minority Investments are excluded from operational metrics and number of properties but included in GAV. Totals may not sum due to rounding.

(1) Gross asset value calculated as the sum of (a) total market value of the properties under management, including the total value of related equity and debt positions, joint venture and co-investment ownership positions and (b) the market value of Minority Investments. The market value of Minority Investments is calculated as the percentage of the market value of the relevant asset equal to the Combined Group’s Minority Investment; calculated as of 30 June 2025 unless stated otherwise.

(2) Represents the embedded growth potential between BPPEH’s in-place rents and achievable market rents. For residential, based on the lesser of legal rent constraint, where applicable, or market rate where regulation does not include a specific rent limit.

(3) Includes one leasehold interest in a 5-star hotel in central Milan, one development asset in central Milan and Minority Investments.

(4) Nordics includes Sweden (6%), Denmark (3%), Norway (<1%) and Finland (<1%).